Summary of Financial News for December 2025 sources from Reuters, AP News, Finance

and Commerce, The Guardian, Al Jazeera, Financial Times, Nerd Wallet.

1.Federal Reserve Cuts Interest Rates Amid Mixed Outlook – 11th December 2025

At its December meeting, the Federal Reserve cut the federal funds rate by 25 basis

points to a range of 3.50% — 3.75% and signalled that future changes may be

measured, reflecting a balancing act between persistent inflation and a cooling labour

market.

2.Consumer Confidence Slumps to Multi-Month Low – 23rd December 2025

The Conference Board’s consumer confidence index fell to its lowest level since April,

with high prices and tariffs weighing on sentiment despite solid headline GDP figures

earlier in the month.

3.Strong Q3 GDP Growth Beats Expectations – 23rd December 2025

The Commerce Department reported that the U.S. economy expanded at an

annualised 4.3% rate in the third quarter—its fastest pace in two years—a sign of

underlying resilience even as some indicators soften going into year-end. U.S. GDP

grew at a 4.3% annual rate in Q3, the fastest pace in two years. Consumer spending

and government investment drove economic growth. Inflation rose, with core PCE

climbing to 2.9%, above the Fed’s target of 2.8%. Strong growth and higher inflation

reduce the chances of a near-term Fed rate cut.

4.Political Commentary Impacts Central Bank Leadership Discussions – 24th

December 2025

President Trump made headlines for stating that Federal Reserve leadership would

depend on alignment with his economic views, signalling potential shifts in central

bank governance and policy direction.

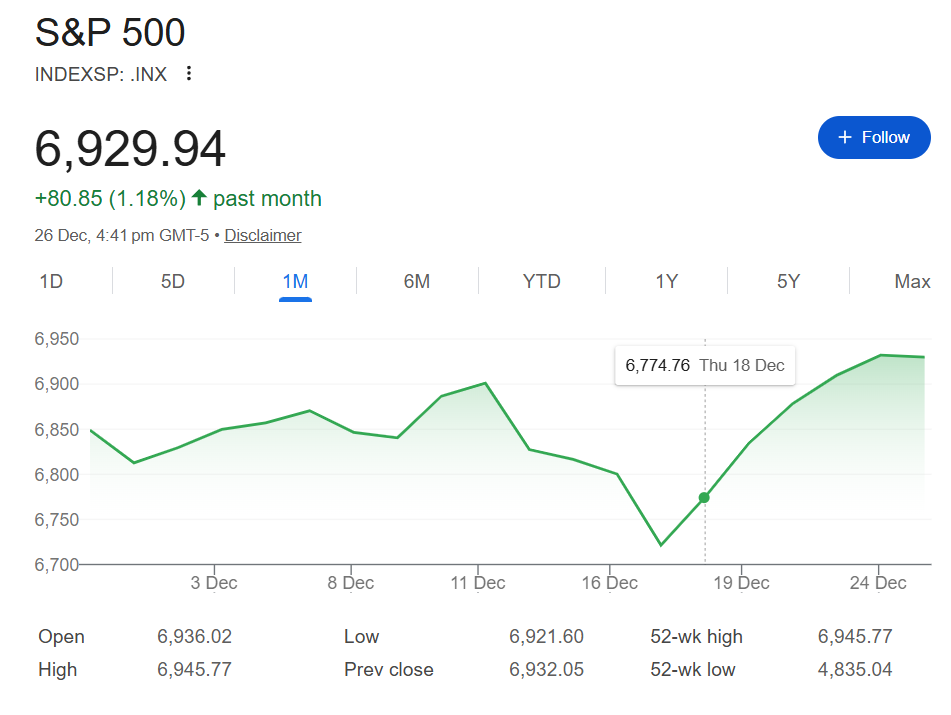

5.U.S. Markets Poised for Strong Year-End Close – 26th December 2025

Major U.S. stock indexes, including the S&P 500, are near record highs and headed for a

strong finish to 2025, with the S&P 500 approaching the 7,000 mark as market breadth

broadens beyond large tech firms. Equity performance has been supported by

economic resilience and easing expectations for monetary policy.

6.Tech Wealth Surge from AI Rally – 26th December 2025

The booming AI sector contributed significantly to wealth gains among U.S. tech

magnates in 2025, adding hundreds of billions of dollars to their net worth and

underscoring the outsized impact of AI-led equities on the broader market.

7.Global M&A Activity Strong Amid Regulatory and Market Tailwinds – 26th

December 2025

Global dealmaking reached approximately $4.5 trillion in 2025—the second-highest on

record—with U.S. transactions playing a significant role, reflecting favourable financing

environments and strategic corporate objectives.

8.Trade Policy Shifts Continue to Influence Economic Dynamics – 26th December

2025

U.S. trade policy changes throughout 2025, particularly higher tariffs on imported goods,

continued to generate economic debate. These policies affected trade flows, domestic

prices and business planning, adding to volatility in markets and consumer sentiment.

Trump’s higher tariffs are certainly raising money. They’ve raked in more than $236

billion this year through November — much more than in years past.The U.S. trade

deficit, meanwhile, has fallen significantly since the start of the year.

9.Notable Growth Stocks Highlight Market Performance Trends -23rd December

2025

Analyses of December’s performance identified several growth stocks outperforming

broader market indices, indicating investor appetite for firms with strong revenue and

earnings expansion potential even amid macro uncertainty. Some of these, specified by

various analysts, were Avino Silver & Gold Mines Ltd, Lumentum Holdings Inc, Power

Solutions International Inc, New Gold Inc, IREN Ltd, Source: Finviz. Stock data is current as

of December 23, 2025, and is intended for informational purposes only.

10.Blue-Chip Stocks Show Solid Year-End Strength – 23rd December 2025

Large, established companies continued to demonstrate resilience, with several bluechip

stocks performing well in December—a signal of investor confidence in

foundational sectors and long-term corporate earnings stability. Some of the best

performing blue chip stocks were Micron Technology Inc., Lam Research Corp, GE

Aerospace, Citigroup Inc, Alphabet Inc, Goldman Sachs Group, Inc, Caterpillar Inc.

A few takeaways for December 2025 marked a transition month for the U.S. economy:

Growth remained strong on paper (Q3 GDP data),

Confidence and hiring softened beneath the surface,

Inflation pressures eased but did not disappear,

Policymakers shifted decisively from restraint to calibration.

For investors and decision-makers, the macro environment at year-end 2025 was

constructive but fragile—favourable for risk assets, yet highly sensitive to labourmarket

deterioration or renewed price shocks.

Underlying Economic Themes for December 2025

Monetary Policy Landscape

The Federal Reserve’s December rate cut capped a period of monetary easing intended

to support slower employment growth and manage inflation expectations, though

future rate moves remain uncertain given mixed macro indicators.

Consumer and Business Sentiment

While headline GDP figures were strong, key sentiment measures—including consumer

confidence and purchasing manager indices—showed deceleration, suggesting some

softening in economic momentum as the year concluded.

Market Structure and Sector Rotation

Equity markets exhibited signs of sector rotation beyond mega-cap tech, with financials,

healthcare, and industrials showing relative strength—a pattern consistent with

broadening investor confidence.

Trade and Policy Impact

Tariff policy remained a dominant discussion point in December, both in terms of its

direct economic effects and its influence on business planning and international trade

dynamics.

How the S&P 500 Moved Through December 2025

1.Early December (Dec 1–6): Range-Bound, Policy Anticipation

Market behaviour: Sideways to modestly higher.

Narrative: Investors positioned cautiously ahead of the Federal Reserve meeting.

Drivers: Inflation is trending lower but still sticky, and the Labour market is cooling but

not weak

Interpretation: Markets priced high confidence in a rate cut, limiting downside

volatility.

2.Mid-December (Dec 10–13): Fed Cut led to Relief Rally

Event: Federal Reserve delivers a 25 bp rate cut.

Market reaction: Upward break from the early-month range.

Interpretation: The rally was orderly, not euphoric—confirming this was a riskmanagement

cut, not stimulus-driven speculation. Sectors that led the market were

Technology, Financials, and Industrials.

3.Mid-to-Late December (Dec 16–20): Digesting Mixed Data

Negative input: Business activity and consumer confidence softened.

Positive offset: Earnings expectations remained intact.

Market behaviour: Shallow pullbacks, quick recoveries.

Interpretation: This was a healthy consolidation, consistent with late-cycle markets

that trust earnings more than sentiment surveys.

4.Dec 23: Q3 GDP Surprise led for New Highs

Event: Q3 GDP confirmed at around 4.3% annualised.

Market reaction: S&P 500 pushed to new record levels.

Important nuance: GDP strength was backwards-looking, and Markets did not

reprice aggressive growth

Interpretation: Investors treated GDP as confirmation of resilience, not a reason to

fear renewed inflation or rate hikes.

5.Final Week (Dec 24–31): Santa Rally and Thin Liquidity

Market behaviour: Mild upward drift, low volume.

Characteristics: No panic buying and no distribution signals

Interpretation: Classic late-cycle Santa rally is confidence-driven, not liquiditydriven.

Baseline View for S&P 500 January 2026 Predictions

S&P 500 : Constructive but range-bound, with upside skew

January likely extends December’s trend slowly, not explosively. Gains come from

earnings confidence, not macro surprises. Rate cuts have already been delivered;

therefore, January 2026 lacks a policy shock. In December 2025, the market has

projected strong early earnings pre-announcements, Softer wage data reinforcing ratecut

optionality, and renewed inflows into large-cap quality with mega-cap technology,

finance, and Healthcare sector-focused. This led us to interpret the market January

data as “growth without inflation” with a narrow but powerful outcome. Key factors to

watch for January 2026 are labour data and Q4 earnings. Unless labour data

deterioration and earnings downgrade, there would be no reason for any drawdown.

Even in that case, it is more likely a reset and not the start of a bear market. Investors

may choose to maintain some cash, not chase the early January 2026 strength, and

buy on dips. January 2026 is more likely to reward discipline than aggressiveness. The

S&P 500 can move higher, but only at the pace earnings allow.